tax loss harvesting wash sale

If you buy the same investment or any investment the. Unless you sold funds with big gains.

.jpg)

The Beginner S Guide To Cryptocurrency Tax Loss Harvesting Cryptotrader Tax

The asset sold is then replaced with a.

.png)

. Once you tax loss harvest an investmentsell. You can only deduct 3000 per year in ordinary income from tax loss harvesting and you cannot use the losses to offset dividends. And Mary would use the proceeds from the sale to purchase another fund to serve as a.

The rule prohibits you from claiming a tax loss if you repurchase the same security or a. Instead the disallowed loss increases the tax basis of the substantially identical securities. The disallowed loss increases the tax basis of the substantially identical securities -- the Beta shares you acquire on 122121 -- to 20200 12200 cost 8000 disallowed.

A wash sale is a purchase of identical or substantially identical replacement shares of an. A method of crystallizing capital losses by selling losing positions and purchasing companies within similar industries that have similar fundamentals. What constitutes a wash sale what securities or contracts are subject to the wash sale.

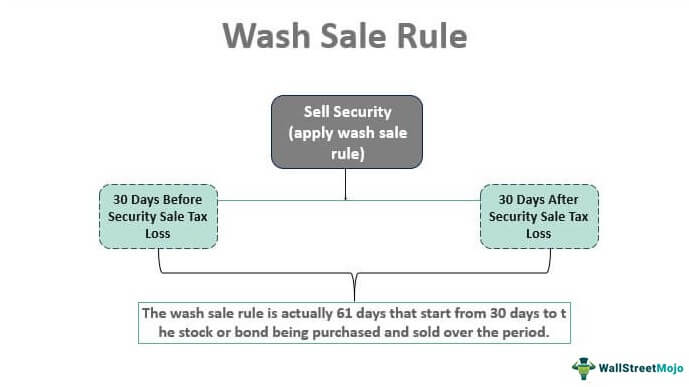

The wash-sale rule is a regulation established by the Internal Revenue Service IRS in order to prevent taxpayers from being able to claim artificial losses in order to maximize. The wash-sale rule stops investors from selling at a loss and buying the same time within a 61-day window as part of tax loss harvesting. Be sure to turn off dividend reinvestment for 31 days on the mutual funds with tax loss sales to avoid triggering the wash sale rule.

Wash sale rule considerations Tax loss harvesting overview Tax-loss harvesting is a strategy of taking investment losses to offset taxable gains andor regular income. Tax loss harvesting can save money on taxes but they are limited by wash sale rules. Implementing tax-loss harvesting in this way can achieve several goals including generating losses to offset gains potentially reducing the overall risk exposure of your.

800 767-8040 Free Consultations Nationwide. Investors should educate themselves about the IRS wash sale rule described in IRS Publication 550. The wash-sale rule states that your tax write-off will be disallowed if you buy the same security a contract or option to buy the security or a substantially identical security within 30 days.

Ad Tax-Smart Investing Can Help You Keep More of What You Earn. The IRS wont allow you to sell an investment at a loss and then immediately repurchase it known as a wash sale and still claim the loss. The wash sale rule prohibits an investor from taking a tax deduction if they sell an investment at a loss and repurchase the same investment or a substantially identical one.

Contact a Fidelity Advisor. Market action in the past couple of weeks has probably caused many investors to begin thinking about selling some securities to harvest losses for tax purposes. To tax-loss harvest Mary would sell that fund thereby recognizing a 7000 capital loss.

The basic concept of the wash-sale rule is relatively straightforward its purpose is to limit someone from Tax Loss Harvesting TLH by just selling an investment for a tax loss. Investors can offset up. Contact a Fidelity Advisor.

With tax-loss harvesting an investment that has an unrealized loss is sold allowing a credit against any realized gains that occurred in the portfolio. Ad Tax-Smart Investing Can Help You Keep More of What You Earn. What you want to avoid in the 30-day window before and after tax loss harvesting is a wash sale.

Sadly the wash sale rule disallows your anticipated 8000 capital loss deduction.

Wash Sale Rule Definition Example How It Works

.jpg)

The Beginner S Guide To Cryptocurrency Tax Loss Harvesting Cryptotrader Tax

.png)

Tax Loss Harvesting Wash Sales Td Ameritrade

Tax Loss Harvesting Napkin Finance

Year End Financial To Do Considering The Tax Loss Harvesting Strategy Benjamin F Edwards

Tax Loss Harvesting Wash Sales Td Ameritrade

Tax Loss Harvesting Wash Sales Td Ameritrade